All Categories

Featured

Table of Contents

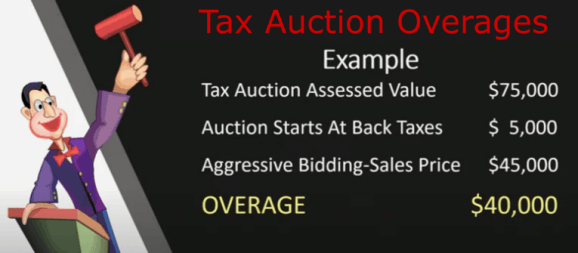

Tax obligation sale overages, the excess funds that result when a property is offered at a tax obligation sale for more than the owed back tax obligations, charges, and costs of sale, represent an alluring possibility for the initial property proprietors or their successors to recoup some value from their lost possession. The process of declaring these excess can be complicated, mired in lawful procedures, and differ dramatically from one territory to another.

When a home is cost a tax sale, the key objective is to recover the overdue residential property tax obligations. Anything over the owed quantity, consisting of charges and the cost of the sale, becomes an excess. This excess is basically cash that needs to rightfully be returned to the former property owner, assuming nothing else liens or cases on the property take precedence.

Recovering tax obligation sale excess can certainly be tough, stuffed with legal intricacies, administrative difficulties, and potential challenges. However, with proper preparation, recognition, and occasionally specialist aid, it is possible to browse these waters efficiently. The key is to come close to the process with a clear understanding of the demands and a critical strategy for dealing with the challenges that might occur.

Surplus Payment

You might have amazing investigative powers and a group of scientists, yet without recognizing where to look for the money, and just how to get it out lawfully, it's simply intriguing details. Currently imagine for a minute that you had actually an examined, confirmed 'treasure map' that revealed you exactly how to locate the cash and how to obtain it out of the court and into your account, without fretting about finder laws.

Up until currently that is . Yes! . what once was impossible is now conveniently accomplished . And what we show you will certainly have a larger influence on your monetary future than anything else you have ever seen online. Claim big blocks of cash, some $100K+!, with absolutely no competitors? Were the only ones that additionally pursue mortgage and HOA foreclosure overages! Partner with a company that will train you and do all the hefty lifting for you? Operate a company that will enable You to foretell and has no limitation on income? Have access to YEARS of files, where you could literally select & choose what to take? Assist various other individuals while you are creating individual wide range? Make no mistake - this is not a 'obtain rich fast' program.

Avoid tracing is the process of locating existing call details, such as addresses and phone numbers, to find and call somebody. In the past, avoid mapping was done by debt collector and private detectives to locate people that where avoiding out on a financial debt, under investigation, or in difficulty with the law.

To get clear title after a tax obligation activity has actually been gotten, please contact a lawyer to start that treatment. The purchaser of a mobile home will certainly be required to accredit a restricted power of attorney to permit the County to title the mobile home in your name at the SCDMV along with register the mobile home with the County.

The legislation asks for that an insurance claim be submitted. By regulation, we can not authorize situations after one year from the taped day, neither can we begin handling of instances up until one year has passed from the precise same day. The Taxation firm will send a recommendation to the Board of Supervisors pertaining to the personality of the excess earnings.

The homes cost the DLT sale are marketed to accumulate delinquent tax commitments owed to Jackson Region, MO. If the residential or commercial property costs higher than what is owed in tax obligation responsibilities and fees to the Region then existing document owners(s) or other interested events, such as, a lien proprietor might ask for those funds.

Tax Default Homes

Please note: This information is for academic functions simply and is not legal ideas or an alternative to working with lawful suggest to represent you. No attorney-client link or advantage has really been created as a result of this discussion and no privacy affixes to anything said here on a public web site.

The The Golden State Profits and Taxes Code, Area 4675, states, in part (reworded): Events of Price of rate of interest and their order of concern are: First, lien proprietors of document prior to the recordation of the tax obligation action to the buyer in the order of their top concern (Unclaimed Tax Sale Overages). Any kind of sort of private with title of file to all or any kind of section of the residential building before the recordation of the tax act to the buyer.

Tax Obligation Sale Overages Tax Auction Overages Prior to the choice by the Court, Michigan was amongst a minority of states who allowed the retention of surplus make money from tax-foreclosure sales. excess sales. Residential or business homeowner that have in fact lost their home as a result of a tax repossession sale currently have an insurance claim versus the location for the difference between the quantity of tax obligation responsibilities owed and the amount comprehended at the tax obligation sale by the Area

In the past, miss mapping was done by financial debt collector and private investigators to find individuals that where avoiding a debt, under investigation, or in trouble with the regulations.

That is required to file tax overages hand-operated pdf? All people that are needed to submit a government earnings tax return are likewise called for to file a tax obligation excess manual.

Homes Tax Foreclosure

Depending on their filing status and income level, some people might be called for to file a state income tax obligation return. The handbook can be found on the Internal Income Service (INTERNAL REVENUE SERVICE) website. Exactly how to submit tax excess hands-on pdf? 1. Download the appropriate PDF form for submitting your taxes.

Complying with the instructions on the form, load out all the fields that are appropriate to your tax circumstance. When you come to the section on filing for tax excess, make certain to supply all the information required.

4. As soon as you have actually completed the kind, make certain to double check it for accuracy prior to submitting it. 5. Send the type to the pertinent tax obligation authority. You will typically require to mail it in or submit it online. What is tax obligation overages manual pdf? A tax obligation overages hands-on PDF is a paper or guide that offers information and directions on exactly how to locate, accumulate, and case tax excess.

Tax Lien Foreclosure Properties

The excess quantity is typically refunded to the proprietor, and the manual supplies guidance on the process and treatments included in claiming these refunds. What is the objective of tax overages hand-operated pdf? The purpose of a tax excess manual PDF is to provide details and support relevant to tax obligation excess.

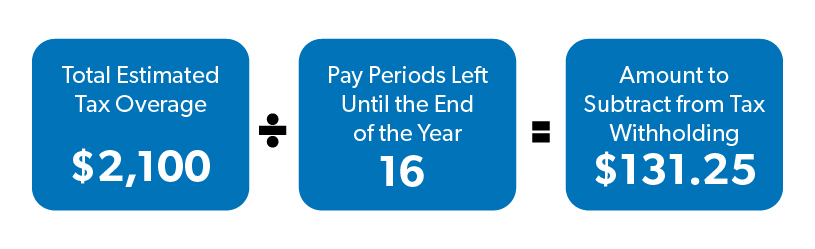

Tax obligation Year: The specific year for which the excess is being reported. Quantity of Overpayment: The total amount of overpayment or excess tax obligation paid by the taxpayer. Resource of Overpayment: The reason or resource of the overpayment, such as excess tax withholding, approximated tax payments, or any kind of various other applicable source.

Reimbursement Request: If the taxpayer is requesting a reimbursement of the overpayment, they need to show the amount to be reimbursed and the favored approach of reimbursement (e.g., straight down payment, paper check). 6. Supporting Documents: Any kind of appropriate sustaining documents, such as W-2 forms, 1099 forms, or other tax-related invoices, that confirm the overpayment and validate the refund request.

Trademark and Date: The taxpayer must authorize and date the file to license the accuracy of the details given. It is necessary to note that this information is common and may not cover all the specific needs or variations in various areas. Always seek advice from the pertinent tax obligation authorities or speak with a tax specialist for accurate and updated information concerning tax overages reporting.

Table of Contents

Latest Posts

Tax Lien Investing Guide

Sales In Excess

Homes In Tax Foreclosure

More

Latest Posts

Tax Lien Investing Guide

Sales In Excess

Homes In Tax Foreclosure